Financial Recognition

Recognise the financial impact of accrued expense and revenue programs as they occur instead of waiting for month end.

Margins are updated within orders and the P&L in real-time or at a minimum as invoices are posted to the general ledger.

What it does

Flintfox efficiently posts expenses and revenue/income to the P&L statement as underlying activities occur, with the corresponding accruals recorded on the balance sheet.

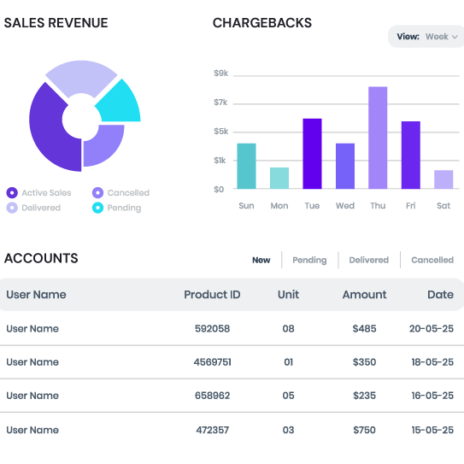

This system facilitates real-time financial updates, including when a distributor sells products with an authorised chargeback or Supplier Pricing Agreement (SPA) from the supplier.

The vendor revenue is recognised simultaneously with the sales invoice posting.

This capability extends to recognising revenue and expenses for accrued programs such as SPAs, chargebacks, billbacks, rebates, royalties and other retrospective payment programs.

What it solves

Flintfox addresses the challenge of delayed financial reporting, by ensuring the P&L reflects real-time activities.

You no longer wait until the supplier is billed for chargebacks or SPAs.

By synchronising revenue recognition with the occurrence of sales and other relevant activities, we eliminate discrepancies between actual operations and financial records.

This enhances the accuracy of financial statements and increases compliance with accounting standards.

The outcome

Our solution ensures P&L margins are accurate and up-to-date throughout the year.

By recognising the financial impact of sales and other activities at the moment they occur, businesses can maintain consistent and reliable financial oversight.

This accuracy in financial reporting supports better strategic decision-making and financial planning.

You can use this information for effective financial management.

Pricing solutions for all types of businesses

Get started with a free demo

We’ll show you exactly how Flintfox works with your ERP to help you protect margins and maximise revenue.